AvidXchange Inc has emerged as a leading force in transforming how businesses handle accounts payable. With the rise of digital transformation in finance, traditional paper-based invoicing and manual payments are becoming obsolete. Companies like AvidXchange are leading this shift, offering innovative, automated solutions for mid-market businesses that want to streamline processes, reduce errors, and increase efficiency.

In this detailed article, we’ll break down what makes AvidXchange Inc a powerful player in the financial technology sector. We’ll cover its products, market impact, benefits, growth trajectory, and why it’s a top choice for accounts payable automation. We’ll also explore how it fits into the broader fintech landscape.

Introduction to AvidXchange Inc

AvidXchange Inc is a leading provider of accounts payable (AP) automation and payment solutions. Based in Charlotte, North Carolina, the company helps middle-market businesses transition from manual, paper-intensive processes to streamlined digital workflows. With AvidXchange, companies can manage invoices, approvals, and payments all in one centralized platform.

AvidXchange is more than just a software provider—it’s a strategic partner for businesses looking to modernize their back-office operations.

A Brief History and Background

Founded in 2000, AvidXchange started with a vision to eliminate paper checks and automate payments. The idea stemmed from a clear market need—many businesses were bogged down with inefficient, costly AP processes.

Over the past two decades, AvidXchange has grown into a fintech unicorn, serving over 8,000 customers and processing more than $145 billion in transactions annually. It has built a robust network of over 965,000 suppliers, making it one of the largest B2B payment networks in the United States.

The company went public in October 2021, trading on the Nasdaq under the ticker AVDX, marking a major milestone in its growth story.

Core Products and Solutions

AvidXchange offers a suite of cloud-based solutions designed to automate every part of the accounts payable process:

1. AvidInvoice

This solution allows businesses to receive, track, and approve invoices digitally. It eliminates the need for physical mail, scanning, and manual data entry.

2. AvidPay

With AvidPay, companies can pay vendors electronically using various methods such as virtual cards, ACH, and checks. This reduces fraud risks and improves cash flow management.

3. AvidBuy

AvidBuy integrates purchase order (PO) automation into the workflow. It helps enforce spend control policies and streamlines purchasing across departments.

4. AvidXchange Strongroom

Tailored for real estate and HOA (Homeowner Association) companies, Strongroom ensures secure payments and approval workflows specific to this industry.

5. AvidUtility

Built for utility bill management, this solution helps track usage, avoid late fees, and automate recurring utility payments.

How AvidXchange Works

AvidXchange follows a SaaS (Software-as-a-Service) model. Here’s how a typical workflow looks:

- Invoice Capture: Suppliers send invoices directly to AvidXchange (via email, upload, or integration).

- Invoice Approval: AvidInvoice routes the invoice through custom approval workflows for digital sign-offs.

- Payment Execution: Once approved, AvidPay handles the disbursement through preferred payment methods.

- Audit & Reporting: The system provides a digital trail, reporting, and compliance-ready audit logs.

This seamless process helps companies save time, improve transparency, and reduce errors.

Also read: Is Abbate Villagomez a Scam? A Detailed Investigation

Industries Served by AvidXchange

AvidXchange Inc focuses on the mid-market segment across various industries:

- Real Estate

- Construction

- Healthcare

- Nonprofits

- Education

- Hospitality

- Financial Services

- Utilities

These sectors often deal with high invoice volumes and complex vendor relationships—making automation a game-changer.

Key Benefits of Using AvidXchange

1. Time Savings

Manual invoice processing can take days. AvidXchange reduces that time to hours or even minutes.

2. Cost Efficiency

By going paperless, companies save on printing, postage, and storage—plus fewer late fees.

3. Fraud Prevention

Secure payment workflows and digital approvals reduce the risk of check fraud and internal errors.

4. Real-Time Visibility

Dashboards and reporting tools give AP teams full visibility into invoice status, approvals, and cash flow.

5. Compliance and Audit Readiness

AvidXchange helps organizations stay compliant with tax regulations, GAAP, and audit requirements.

6. Supplier Satisfaction

Fast, reliable payments improve vendor relationships and eliminate follow-up calls.

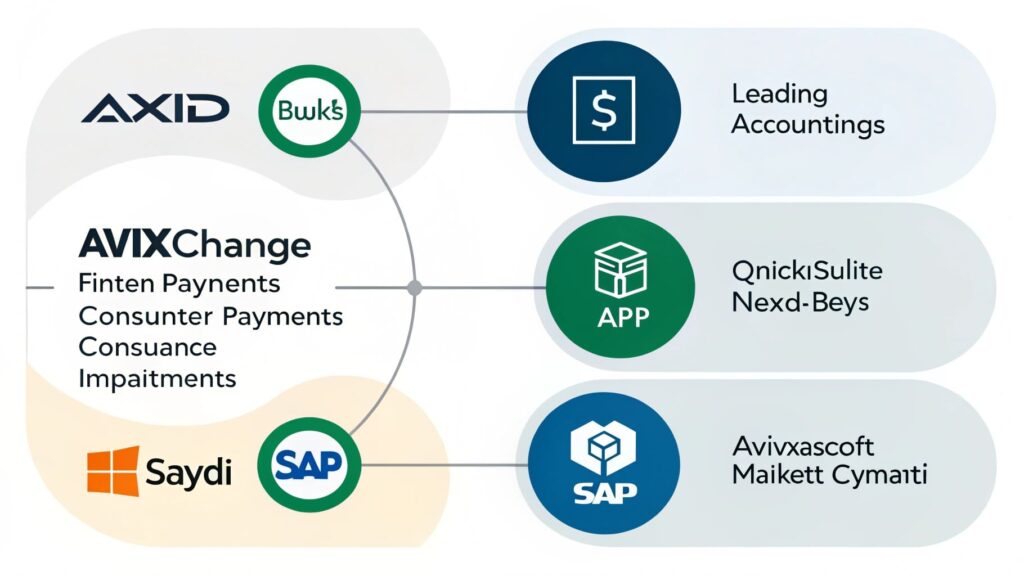

AvidXchange in the Fintech Ecosystem

AvidXchange stands out in the fintech space due to its laser focus on B2B payments. Unlike consumer fintech apps, AvidXchange serves complex enterprise needs and integrates with leading accounting systems like:

- QuickBooks

- NetSuite

- Microsoft Dynamics

- Sage

- Yardi

Its open API and ERP integrations make it flexible for companies of various sizes and industries.

Additionally, AvidXchange competes and collaborates with players like Bill.com, SAP Concur, and Tipalti, showing its maturity and relevance in a competitive space.

AvidXchange IPO and Financial Performance

In October 2021, AvidXchange Inc completed its IPO, raising around $660 million. This helped it expand product offerings, invest in R&D, and grow its supplier network.

While the company has yet to reach profitability (common for fast-growing SaaS firms), its revenue growth has remained strong, especially as more businesses shift to automation post-pandemic.

Notable financial stats (as of 2024):

- Revenue: Over $400 million annually

- Customer Retention Rate: Over 95%

- Gross Payment Volume (GPV): Exceeding $145 billion

This growth reflects strong product-market fit and a sticky customer base.

Why Businesses Are Switching to AvidXchange

With the shift to hybrid work and increasing pressure to digitize back-office functions, AvidXchange is in the right place at the right time.

Reasons why companies are adopting AvidXchange:

- Remote work compatibility

- Vendor diversity and payment flexibility

- Improved financial control

- Lower AP team workload

- Risk reduction through automation

For CFOs and finance leaders, AvidXchange is an attractive solution to bring strategic clarity to a traditionally chaotic process.

Also read: Joinmyquiz .com

Challenges and Future Outlook

Like any fast-scaling company, AvidXchange Inc faces challenges:

1. Profitability Pressure

As a public company, investors want to see consistent profitability, not just growth.

2. Competition

The AP automation space is growing, with new fintech startups and legacy ERP systems offering similar features.

3. Cybersecurity

Handling billions in payments means AvidXchange must invest heavily in security and fraud detection.

4. Macroeconomic Factors

Rising interest rates, inflation, and economic uncertainty can affect customer budgets and growth projections.

Future Outlook:

Despite these challenges, AvidXchange is well-positioned. Its continued investment in AI, machine learning, and predictive analytics will only strengthen its value proposition.

FAQs about AvidXchange Inc

1. What does AvidXchange Inc do?

AvidXchange Inc provides cloud-based software to automate the accounts payable process, including invoice processing, approval workflows, and supplier payments.

2. Is AvidXchange secure?

Yes, AvidXchange uses encryption, authentication protocols, and fraud-prevention measures to secure financial data and payments.

3. Who are AvidXchange’s main customers?

Primarily mid-sized companies in real estate, construction, healthcare, education, utilities, and nonprofit sectors.

4. How much does AvidXchange cost?

Pricing varies by company size, number of invoices, and feature needs. AvidXchange offers custom quotes based on usage.

5. Is AvidXchange publicly traded?

Yes, it trades on the Nasdaq under the ticker AVDX since its IPO in October 2021.

6. Does AvidXchange integrate with accounting software?

Yes, it integrates with popular systems like QuickBooks, NetSuite, Sage, Microsoft Dynamics, and Yardi.

7. How does AvidXchange improve AP processes?

It automates invoice capture, routing, approvals, and payments—reducing manual work, errors, and processing time.

8. Is AvidXchange suitable for small businesses?

It’s designed for mid-market businesses, but some smaller firms with high invoice volume may also benefit.

9. What makes AvidXchange different from other payment tools?

Its specialized focus on B2B payments, supplier network, and industry-specific solutions set it apart from general AP platforms.

10. How can I get started with AvidXchange?

You can request a demo or consultation via their official website to explore the right solution for your business.

Conclusion

AvidXchange Inc is transforming the way businesses handle accounts payable by offering secure, efficient, and automated solutions. With its cloud-based platform, broad industry reach, and growing payment network, it helps mid-market companies streamline operations, reduce costs, and improve financial control. As digital transformation becomes a necessity, AvidXchange stands out as a trusted partner for AP automation and future-ready finance teaConclusion

Related post: